income tax rates 2022 ireland

The Personal Income Tax Rate in Ireland stands at 48 percent. Tax Bracket yearly earnings Tax Rate 0 - 36400.

Accountant High Wycombe Total Tax Accountant Firm Is The Best Organization To Provide The Services Self Employment Business Loans Loan Company Finance Saving

Personal income tax rates.

. Tax credits and rate bands. Use our interactive calculator to help you estimate your tax position for the year ahead. An inheritance tax also known in other countries as a death tax or gift duty is a tax levied against people who receive assets from the estate of a deceased person.

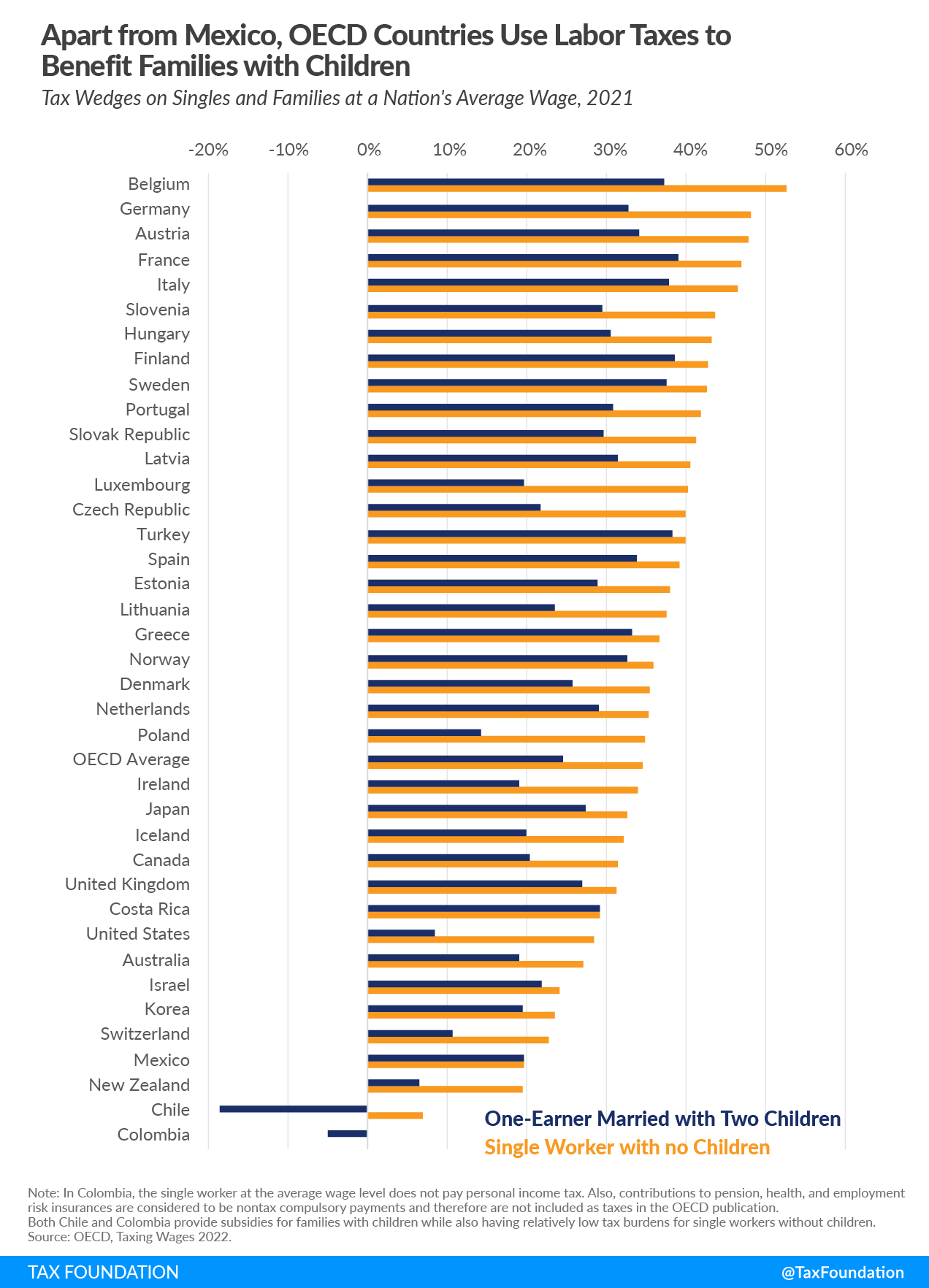

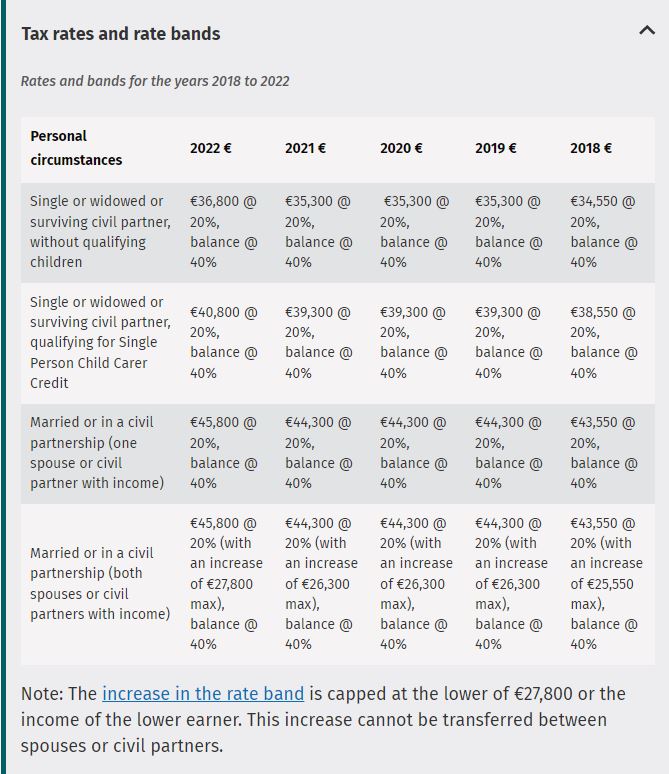

Capital gains rate. Personal income tax rates changed At 20 first At 40 Single person increased 36800 Balance Married couplecivil partnership one income increased 45800 Balance. Table 1 presents the results of this analysis.

Single and widowed person. Ireland Annual Salary After Tax Calculator 2022. Based on Budget 2022 we calculated effective tax rates for a single person a single income pair and a two-earner couple.

We help landlords across Ireland file their rental income tax return. Minister for Finance Paschal Donohoe has said a 30 rate of income tax is technically possible and that Budget 2023 will contain an overall personal tax package that. A standard rate of 20 which applies to lower income levels and a standard tax band of 40 which applies to.

The first part of your income up to a certain amount is taxed at 20. 2022 EUR Tax at 20. Other rates of USC.

What will the provisions contained in Budget 2022 mean for you. The percentage that you pay depends on the amount of your income. Personal Income Tax Rate in Ireland averaged 4565 percent from 1995 until 2020 reaching an all time high of 48 percent in.

The Personal Income Tax Rate in the United Kingdom. Reduced rates of USC. Taxable income Tax rate.

We help landlords across Ireland file their rental income tax return. Total of income tax including USC levies and PRSI as a total income. 12 Votes The Annual Wage Calculator is updated with the latest income tax rates in Ireland for 2022 and is a great.

Payments and income exempt from USC. Ireland has a bracketed income tax system with two income tax brackets ranging from a low of. Rate bands and tax reliefs for the tax year 2022 and.

This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher. Ireland Weekly Salary After Tax Calculator 2022. Resident companies are taxable in Ireland on their worldwide profits including gains.

Ad A high quality low cost tax return service for Irish landlords. Effective Income Tax Rates in Ireland 1997-2022. The personal income tax system in Ireland is a progressive tax system.

The Australian Tax Office. This guide is also available in Welsh Cymraeg. Ad A high quality low cost tax return service for Irish landlords.

The Weekly Wage Calculator is updated with the latest income tax rates in Ireland for 2022 and is a great calculator for working out your. Your Tax Credit Certificate. Get a quote today.

This page shows the tables that show the various tax band and rates together with tax reliefs for the current year and previous four years. The current tax year is from 6 April 2022 to 5 April 2023. To calculate your Income Tax IT you will need to understand how tax credits and rate bands work.

Get a quote today. Standard rates and thresholds of USC for 2022. Non-resident companies are subject to Irish.

This is known as the standard rate of tax and. Income up to 36800. VAT and Sales Tax Rates in United Kingdom for 2022 United Kingdom VAT Rate 1800 About 18 tax on a 100 purchase.

Taxation in Ireland Irish Income Tax is a progressive tax with two tax bands. Standard rates and thresholds of USC.

Ranked Visualizing The Largest Trading Partners Of The U S In 2022 Teaching History World Data Trading

Ireland Tax Income Taxes In Ireland Tax Foundation

Effective Income Tax Rates After Budget 2021 Social Justice Ireland

Paying Tax In Ireland What You Need To Know

Comparing Irish Income Taxation Rates With Other Eu Member States Public Policy

Pwc And Acca The Association Of Chartered Certified Accountants Have Published A New Report In Ireland Business Leader Job Opportunities Business Practices

Medicare Vs Medicaid They Sound Similar How Are They Different Medicaid Medicare Medical Insurance

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

2022 Corporate Tax Rates In Europe Tax Foundation

Tax Losses And Good Tax Governance In Ireland Public Policy

Capital Gains Tax Word Puzzle In Letters Brain Teasers Brain Teasers For Adults Word Puzzles Brain Teasers

Effective Income Tax Rates After Budget 2021 Social Justice Ireland

Effective Income Tax Rates After Budget 2021 Social Justice Ireland

Comparing Irish Income Taxation Rates With Other Eu Member States Public Policy

The Irish Taxation System Trends Over Time And International Comparisons Public Policy